Advertisements

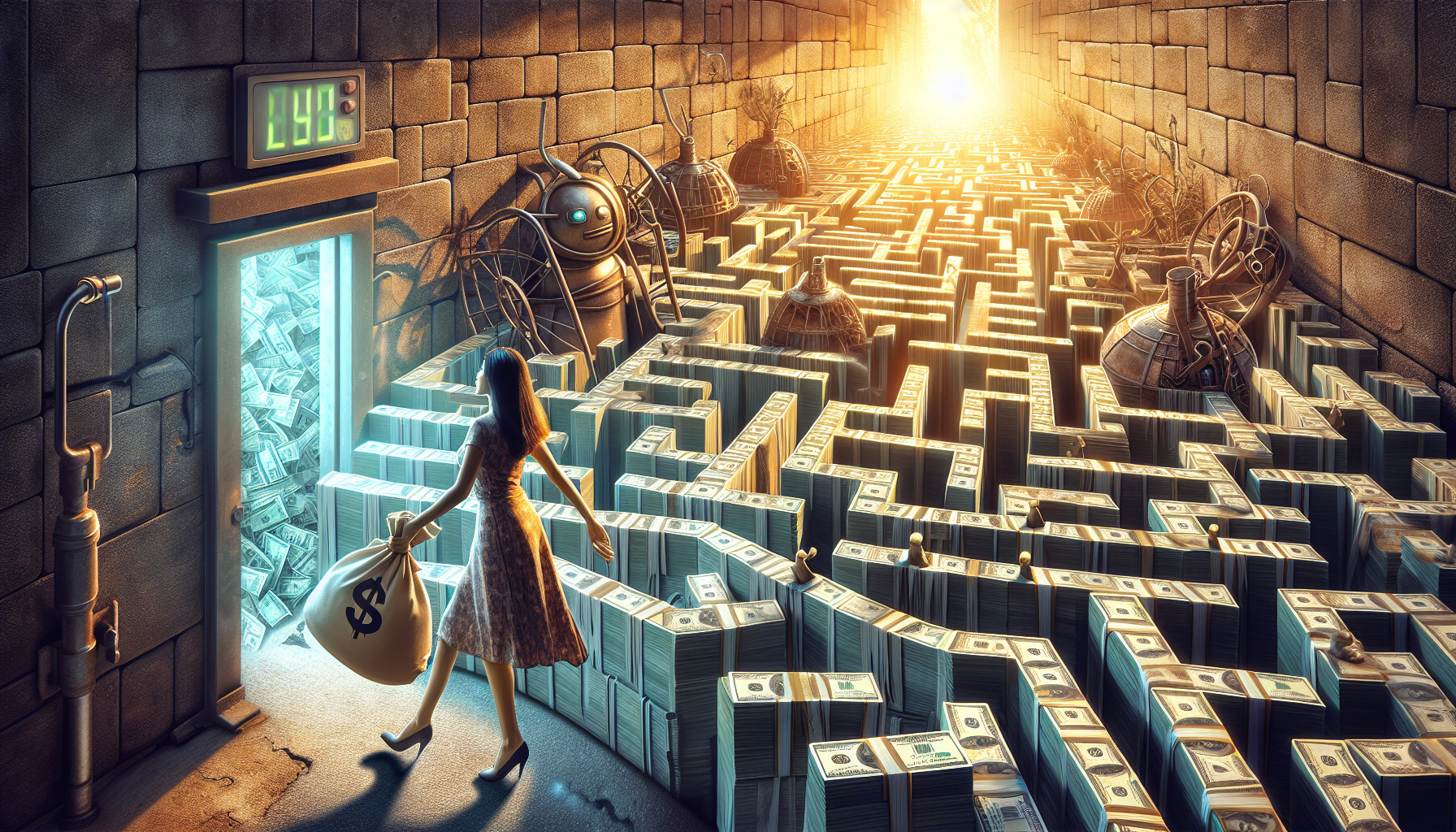

Have you ever stopped to analyze the bank fees that are charged to your account every month? Often, these fees go unnoticed and we end up paying for services that we don't even use. In this article, we will show you how to avoid financial traps and unnecessary bank fees, allowing you to save your money in a smart way.

Throughout this text, we will cover tips and strategies to help you identify which bank fees are really worth paying and which ones can be avoided. We will also show you how to negotiate with your bank to reduce or even eliminate some of these fees, ensuring greater savings at the end of the month.

It is essential to pay attention to the details and read your bank contract carefully so as not to be caught off guard by abusive fees. With well-structured financial planning and due attention to bank costs, you can avoid unnecessary expenses and keep your finances healthy.

So, if you want to learn how to get rid of unnecessary bank fees and save your money, keep reading this content. With the right information and guidance, you will be able to make more informed decisions regarding your finances and ensure greater profitability on your investments.

How to avoid unnecessary bank fees and save your money!

1. Choose the right bank account for you

When choosing a bank account, check what fees are charged and what services are included. Choose an account that suits your needs and offers lower fees or no fees, such as a salary account, digital account or service packages.

Advertisements

2. Avoid overdrafts

Overdrafts are one of the most common financial traps, as they charge high interest rates. Avoid using them and, if necessary, negotiate with the bank to seek more advantageous credit alternatives.

3. Be aware of maintenance fees

Many bank accounts charge monthly maintenance fees. Look for account options with no maintenance fees, or check to see if your bank offers fee waivers if you meet certain requirements, such as using online banking.

4. Use your bank's ATMs

Avoid using other banks' ATMs, as the fees charged may be high. Always use your financial institution's ATMs to make withdrawals and make inquiries.

5. Make transfers via internet banking

Avoid making transfers via TED or DOC, which usually have high fees. Use internet banking to make transfers between accounts at the same bank, which are free in most cases.

- Choose the right bank account for you

- Avoid overdraft

- Be aware of maintenance fees

- Use your bank's ATMs

- Make transfers via internet banking

In addition to comparing different bank account options, it is important to regularly monitor your statements and fees charged to ensure that you are not being surprised by unexpected fees. Using financial control apps can help you monitor your transactions and alert you to possible undue charges. It is also essential to be aware of changes in your bank's service packages and fee policies, updating your choices as necessary to ensure that you are always taking advantage of the best conditions available on the market.

Advertisements

Remember that awareness and ongoing practice of healthy financial habits are essential to ensure the stability and growth of your assets. Always seek to learn more about financial education, keep up with market news and be aware of savings and investment opportunities. With discipline and planning, you will not only be able to avoid unnecessary bank fees, but also achieve your financial goals and build a prosperous and secure future. The key to financial success is in your hands, and each step you take in the right direction will bring you closer to achieving your dreams and goals.

Conclusion

In short, avoiding unnecessary bank fees is essential to saving money and keeping your finances healthy. Choosing the right bank account, avoiding overdrafts, being aware of maintenance fees, using your bank's ATMs and making transfers via online banking are all effective strategies to avoid financial pitfalls.

By choosing an account that meets your needs and offers lower fees, you can avoid spending extra on unnecessary fees. In addition, negotiating credit options with your bank and using online services to make free financial transactions are smart ways to save money.

Remember to always check the terms and conditions of your bank account and look for options that offer benefits and fee exemptions. With planning and attention to detail, you can avoid unpleasant surprises and maintain control over your finances.

Therefore, by following these tips and staying informed about the best financial practices, you will be better prepared to deal with banking pitfalls and ensure a more balanced and peaceful financial life. Don't let unnecessary fees compromise your budget and always be aware of the savings opportunities that may arise in your daily life.

Additionally, ongoing financial education is essential to stay up to date on new ways to save and invest. Attending workshops, online courses, and reading about personal finance can provide valuable insights and advanced money management techniques. Building an emergency fund is also essential to ensure that you are prepared for unexpected situations, thus avoiding the need to resort to credit options with high interest rates.

Additionally, periodically evaluating your spending habits can help you identify areas where you can cut costs and redirect those funds to more productive investments. Choosing banks and financial institutions that offer rewards and cashback programs can further maximize the benefits of your daily financial transactions. Don’t underestimate the power of negotiating with your bank to get better rates and conditions. By combining financial education, ongoing monitoring, and the smart use of technology, you will not only be able to save money, but also build a solid and resilient financial foundation for the future. This integrated approach will ensure that your finances are always well managed and prepared to face any economic challenge.